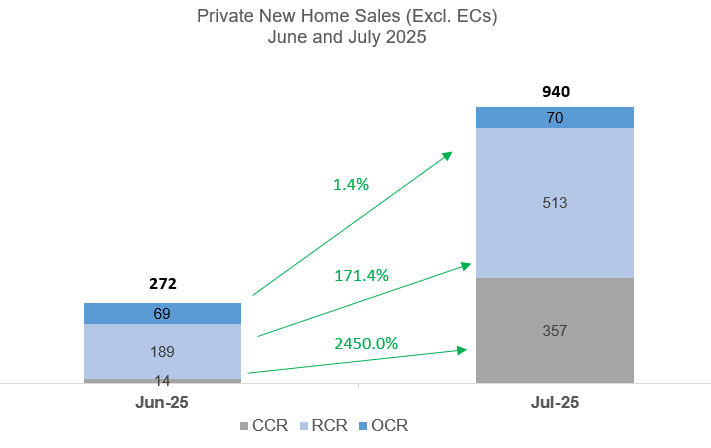

15 August 2025, Singapore - Developers' sales climbed to a 5-month high in July, supercharged by the strong take-up of new units at three fresh project launches during the month. New private home sales came in at 940 units (ex. executive condominiums) in July, marking a more than three-fold increase from the 272 units transacted in the previous month. When compared with July 2024, developers' sales were up by 63% year-on-year from 576 units a year ago.

In all, four new projects hit the market in July, namely LyndenWoods in the Science Park in the city fringe, as well as The Robertson Opus, UpperHouse at Orchard Boulevard, and W Residence Marina View-Singapore in the city. Collectively, the new launches accounted for about 70% of the month's sales, with LyndenWoods, UpperHouse at Orchard Boulevard and The Robertson Opus leading the charge. In July, a new EC project, the 600-unit Otto Place in Plantation Close was also launched and garnered healthy sales.

According to URA's data, developers launched 1,675 new units (ex. EC) for sale in July, significantly higher than the 103 units launched in June.

Source: PropNex Research, URA (15 August 2025)

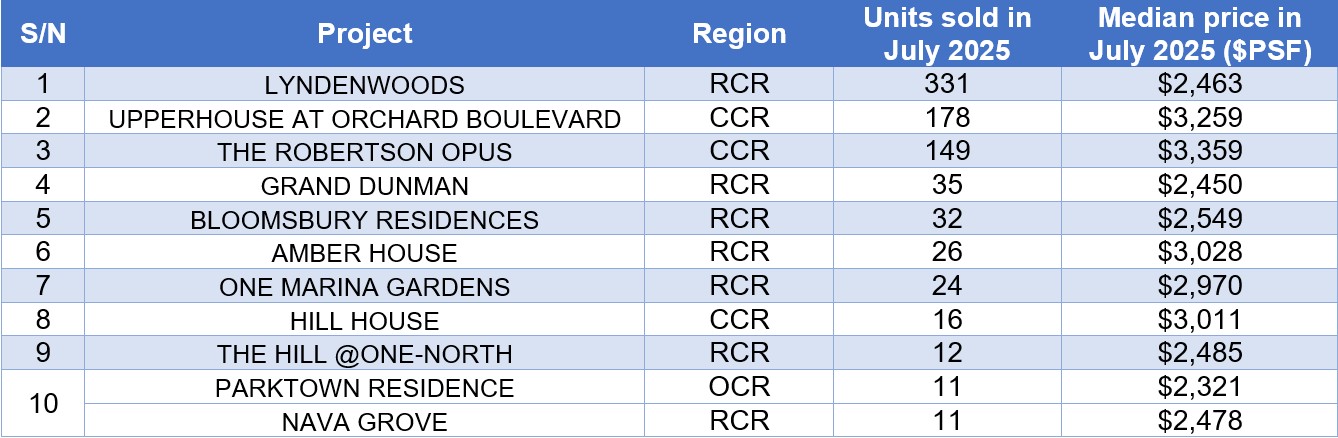

New home sales were led by the Rest of Central Region (RCR), where developers sold 513 new units. The top-seller during the month was the 343-unit LyndenWoods which shifted 331 units at a median unit price of $2,463 psf (see Table 2) - achieving a stellar take-up rate of about 97% since it was launched on 12 July. Meanwhile, several RCR projects continued to pare down on their unsold stock, including Grand Dunman and Bloomsbury Residences which sold 35 and 32 units respectively.

The Core Central Region (CCR) achieved a breakthrough in July, as two new launches sparked a dramatic recovery in this sub-market. Developers' sales in the CCR hit 357 units in July, marking the highest monthly sale in this segment in more than four years, since 443 units were transacted in April 2021. Two projects - The Robertson Opus and UpperHouse at Orchard Boulevard - made up about 92% of the 357 CCR units sold in July. Specifically, the 301-unit UpperHouse at Orchard Boulevard sold 178 units at a median price of $3,259 psf, while the 348-unit The Robertson Opus, a 999-year leasehold mixed-use development moved 149 units at a median price of $3,359 psf. Branded residences, W Residences Marina View-Singapore shifted two units at a median price of $3,344 psf. New private home sales in the CCR are expected to rise further in August, following the successful launch of River Green.

Meanwhile, sales were relatively muted in the Outside Central Region (OCR) given the lack of new private residential project launches in this sub-market. Developers sold 70 new units (ex. EC) in July, marginally higher than the 69 units shifted in the previous month. The most popular OCR project in July was Parktown Residence which sold 11 units at a median price of $2,321 psf. Mass market home sales will also pick up in August as the drought in OCR launches ends - the 376-unit Canberra Crescent Residences in Sembawang was launched on 2 August, while the 941-unit Springleaf Residence in Upper Thomson Road is also set to be rolled out over the coming weekend.

In the EC segment, developers moved 371 new EC units in July, up by more than 11 times from the 33 units transacted in June. The sharp increase can be attributed to the launch of the 600-unit Otto Place EC during the month, where 358 units were sold at a median price of $1,746 psf. As at the end of July, there were 253 unsold new EC units in the market, and this number is expected to decline significantly when the sales booking at Otto Place opens to more second-timer buyers later this month.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"July marked a bright start to the second half of 2025 for developers' sales and in particular, may signal a broader recovery in the CCR sub-market. All in, developers have transacted 5,527 new units (ex. EC) in the first seven months of this year, which is already 85% of the full-year sales in 2024 (6,469 units). Factoring the transactions from new launches in August, we fully expect the new home sales volume in the first eight months of 2025 to exceed the annual developers' sales in each of 2024 and 2023. In fact, it is possible that the new home sales volume may even outperform the 7,099 units shifted in 2022 by the end of August. For the whole of 2025, we project that developers' sales could hit 8,000 to 9,000 units (ex. EC), with more projects slated to be launched later in the year.

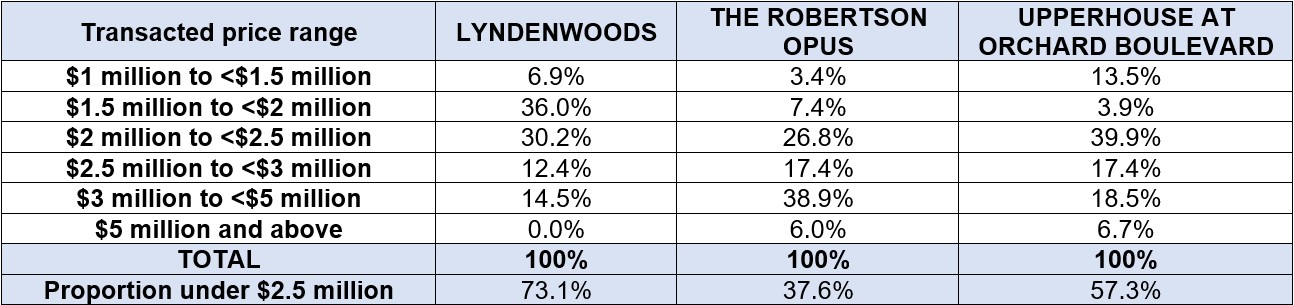

The healthy sales in July reflects the steady underlying demand for new private homes, and it is driven by a favourable mix of easing home loan rates, ample liquidity in the market, low unemployment, and well-priced new launches. For instance, we note that 73% of the units sold at LyndenWoods in July were transacted at below $2.5 million (see Table 1), as per caveats lodged. This meant that a sizable number of units in the project is well within the budget range of many homebuyers today.

Table 1: Proportion of units sold by transacted price range at new projects in July

Similarly, buyers were also drawn to two CCR launches in July. About 38% of the sales at The Robertson Opus - a 999-year leasehold project in District 9 - were done at below $2.5 million. Meanwhile, at UpperHouse at Orchard Boulevard in District 10, around 57% of the transactions in July were priced at under $2.5 million, based on URA Realis caveat data. These may be considered to be accessible pricing for new luxury homes in prime Districts 9 and 10, particularly so for UpperHouse at Orchard Boulevard which is located on the doorstep of an MRT station.

To this end, we note that the 357 new private homes sold in the CCR in July alone has already trumped each of the quarterly sales figure in this sub-market from Q3 2023. With River Green's robust sales in August, it may be clear skies again for the CCR market, after the tightening of the additional buyer's stamp duty (ABSD) measure in April 2023 had cast a pall on the high-end homes segment. Furthermore, much of the CCR non-landed new home sales in July were driven by local buyers. We think the aforementioned competitive pricing strategies adopted by developers have also encouraged more Singaporean buyers to explore buying opportunities in CCR projects.

According to caveats lodged, foreigners (non-PR) made up around 2% of the new non-landed private home sales in the CCR in July. In absolute terms, this reflects seven transactions, namely two at The Robertson Opus, three at UpperHouse at Orchard Boulevard, and one each at Hill House and Orchard Sophia. Meanwhile, Singaporean buyers and Singapore PRs made up 82% and 16% of the CCR non-landed new home sales, respectively in the month.

Overall, we expect quantum play to continue to drive pricing strategy for developers, with a view to hitting the pricing sweet-spot range of $2.5 million or below to generate sales momentum. However, we note that land prices have climbed recently and developers may potentially have less wiggle room to price projects competitively further down the road, particularly if construction cost remains elevated.

Developers' sales activity will remain active in August, with three projects (River Green, Promenade Peak, and Canberra Crescent Residences) already launched, a couple of upcoming ones in the OCR - Springleaf Residence, and landed residential project Springleaf Collection - as well as freehold boutique development, Artisan 8 in the RCR. According to URA Realis caveat data (till 3 August), some 919 new private homes have been transacted in the first few days of August, and new home sales look certain to cross the 1,000-unit mark this month. Moving ahead, the pace of new launches should taper towards end-August in view of the lunar 7th month (Ghost month) starting from 23 August."

Table 2: Top-Selling Private Residential Projects (ex. EC) in July 2025

Explore Your Options, Contact Us to Find Out More!

Selling your home can be a stressful and challenging process, which is why

it's essential to have a team of professionals on your side to help guide you through the journey. Our

team is dedicated to helping you achieve the best possible outcome when selling your home.

We have years of experience and a proven track record of successfully selling homes in a timely

and efficient manner.