Rebound in Resale landed activity in October

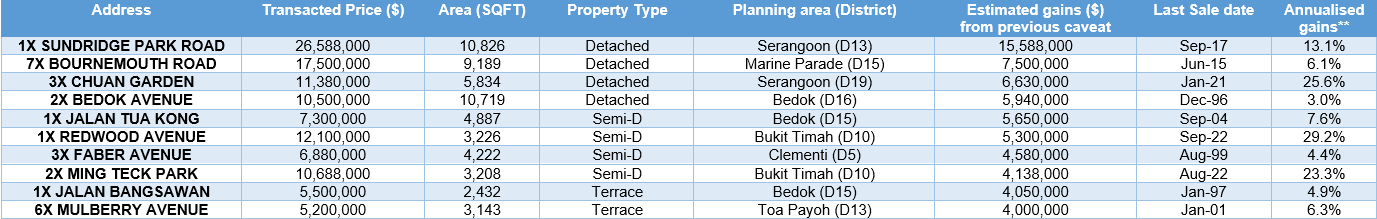

Based on URA Realis caveat data, about 158 landed homes were transacted on the resale market in October 2024; the combined transaction value came up to $812 million - up from September (143 deals valued at $725 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. With the exception of the top gainer, the remaining top 10 landed home transactions in October booked gains ranging from about $4.1 million to $7 million. The top gainers were scattered across the island with a majority located in the suburbs; four out of the top 10 landed transactions are located in the Outside Central Region (OCR); four transactions in the Rest of Central Region (RCR) and another two in the Core Central Region (CCR) during the month.

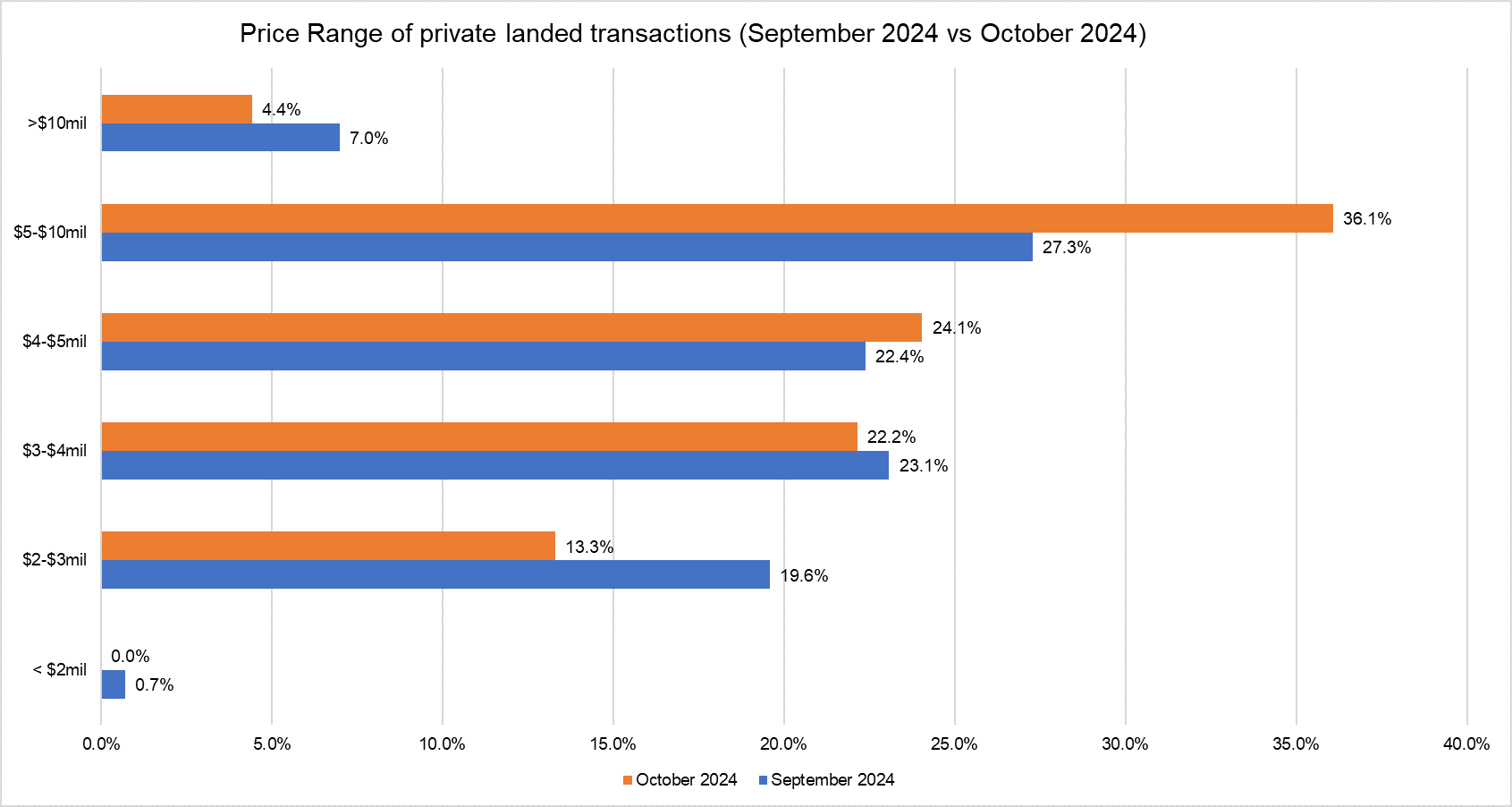

Landed home resale activity in October recovered following a lull in August and September owing to the Hungry Ghost Month. Amidst the pickup in resale activity in October, there was a higher proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 40.5% of resale landed homes sold in October were priced at $5 million and above, compared with about 34.3% in September. Meanwhile, 59.5% of the resale landed transactions were priced at below $5 million in October - lower than the 65.7% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in September 2024 vs October 2024

Source: PropNex Research, URA Realis

Top 10 resale landed transactions in terms of estimated gains*

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a detached property in the OCR, along Sunset Square in District 21. The 2-storey bungalow is situated at a quiet corner of the Clementi Park estate in Clementi. The bungalow was sold for $11.63 million in October and achieved a gross profit of $8.22 million from the last caveated price lodged in September 2006 - booking an annualised gain of 7.1% over 18 years. This freehold bungalow sits on a plot with a land area of over 6,400 sq ft; reflecting a unit price of $1,796 psf on land area.

Top landed transaction with highest gains (Core Central Region)

The second performing transaction in the city was for a detached house in Bukit Timah (District 11) along Sime Road. It was sold for $8.18 million in October, with its last caveat being lodged in November 1998. The sale price is up by about $5.93 million from the previous caveated price, marking an annualised profit of 6.1% over 22 years. Based on a land area of over 4,200 sq ft, the sale price reflects a unit price of $1,914 psf on land area. The property is just a short drive to MacRitchie Reservoir and Keppel Club.

The third best-performing landed transaction in the city was for a bungalow along Trevose Crescent in Novena (District 11). The property was sold for $18 million in October and achieved a gross profit of $5.2 million from the last caveated price lodged in July 2018 - booking an annualised gain of 5.7% within a 6-year holding period. This freehold property sits on a large plot with a land area of more than 8,100 sq ft, with the sale price reflecting a unit price of $2,214 psf on land area. The property is just a short drive away from the Botanic Gardens and Orchard shopping belt. It is also near the Raffles Town Club, Tanglin Community club, and schools such as St Joseph's Institution and Singapore Chinese Girls School.

Top landed transaction with highest gains (Rest of Central Region)

The best performing landed home transaction in the RCR was for a semi-detached house along Shamah Terrace in Bukit Timah (District 21). The property was sold for $11.75 million, reflecting an estimated gain of $7 million, representing a whopping annualised gain of 16% per year from its last caveat lodged in September 2018 - with a holding period of 6 years. The property is located within close vicinity of the Bukit Batok Nature Park and within 10 minutes to the Beauty World commercial node and its cluster of amenities at Beauty World Centre, Bukit Timah Plaza, Bukit Timah Food centre and more.

The second-best performing transaction in the city fringe was for the sale of a semi-detached house in Jalan Sea View in Bukit Timah (District 21). It was sold for nearly $7.8 million in October, with its last caveat being lodged in November 1998. The sale price is up by $6.83 million from the previous caveated price, representing an annualised gain of 8.4% per year over 26 years. The semi-detached house is situated about a 10-minute walk to the recently opened Tanjong Katong MRT station on the Thomson-East Coast Line (TEL).

Top landed transaction with highest gains (Outside Central Region)

The second best performing landed home transaction in the OCR was for a Siglap Walk freehold detached home in District 15 (Bedok) was sold for $12.88 million, up by about $6.4 million from the last caveat lodged in October 2022 - this reflects an eye-watering annualised profit of 45% after a short holding period of 2 years.The semi-detached house is situated within Frankel Estate in the heart of Siglap. It is about a 10-minute walk to Kembangan MRT station on the East-West Line (EWL), which takes commuters to the city within 45 minutes. It is also a short drive to other regional work hubs in the east such as Tampines, Changi Airport and Expo.

The third best-performing landed home transaction in the OCR was for a corner bungalow along Jalan Kayu in the SengKang planning area (District 28). The 999-year leasehold property was sold for about $7.2 million, reflecting an estimated gain of some $4.25 million, representing an annualised gain of 7.1% per year from its last caveat lodged in September 2011, with a holding period of 13 years. The property is located just a short walk to Thanggam LRT station MRT station which takes commuters to SengKang Central and its amenities such as Compass One and SengKang CC in less than 10 minutes.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed homes market.

Explore Your Options, Contact Us to Find Out More!

Selling your home can be a stressful and challenging process, which is why

it's essential to have a team of professionals on your side to help guide you through the journey. Our

team is dedicated to helping you achieve the best possible outcome when selling your home.

We have years of experience and a proven track record of successfully selling homes in a timely

and efficient manner.