There are only two types of singles that would consider buying a private property:

1. You are loaded and can let it rain

2. You are a savvy homebuyer and know the potential of private properties

Whether you are rolling in money or understand how lucrative the private property market is, we are here to explore some things that you should definitely take note of.

Singles are only eligible to buy an HDB flat at 35. As opposed to that, a single person can get private property as young as 21 years old. However, the thing to be mindful of is that you are probably going to earn less at 21 than when you're 35, so it would affect the amount of money you can loan from the banks. But, more on the finances later on.

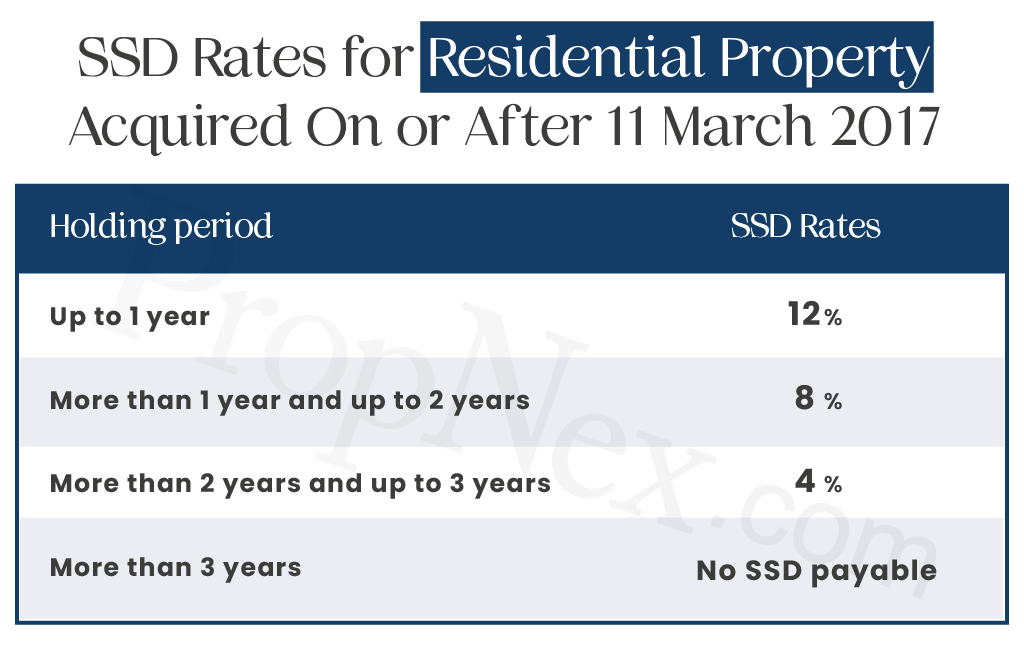

Instead of a Minimum Occupation Period (MOP) of five or 10 years for HDB flats, private properties have Seller's Stamp Duty (SSD).

If you want to find out more about stamp duties, head over here.

Total Debt Servicing Ratio (TDSR), is a crucial measure used by banks to determine your eligibility for a home loan when purchasing a condominium in Singapore.

In essence, TDSR stipulates that the sum of all your current monthly financial obligations along with your projected home loan instalment must not exceed 55% of your monthly income. This includes existing commitments such as personal loans, car loans from banks, and monthly credit card expenditures.

For instance, if your monthly salary is $10,000, your total monthly commitment should not surpass $5,500 to meet the TDSR criteria. To potentially qualify for a higher loan amount (up to 75% of the condo's purchase price), it's advisable to consistently settle your credit card bills in full and on time, and refrain from taking on additional personal or car loans from financial institutions.

For self-employed individuals, banks typically acknowledge only 70 per cent of your most recent annual income as declared in your latest year's Notice of Assessment. This amount is then divided by 12 to determine your recognised monthly income for TDSR calculations.The 30 per cent trimming is what is known in the financial world as a haircut.

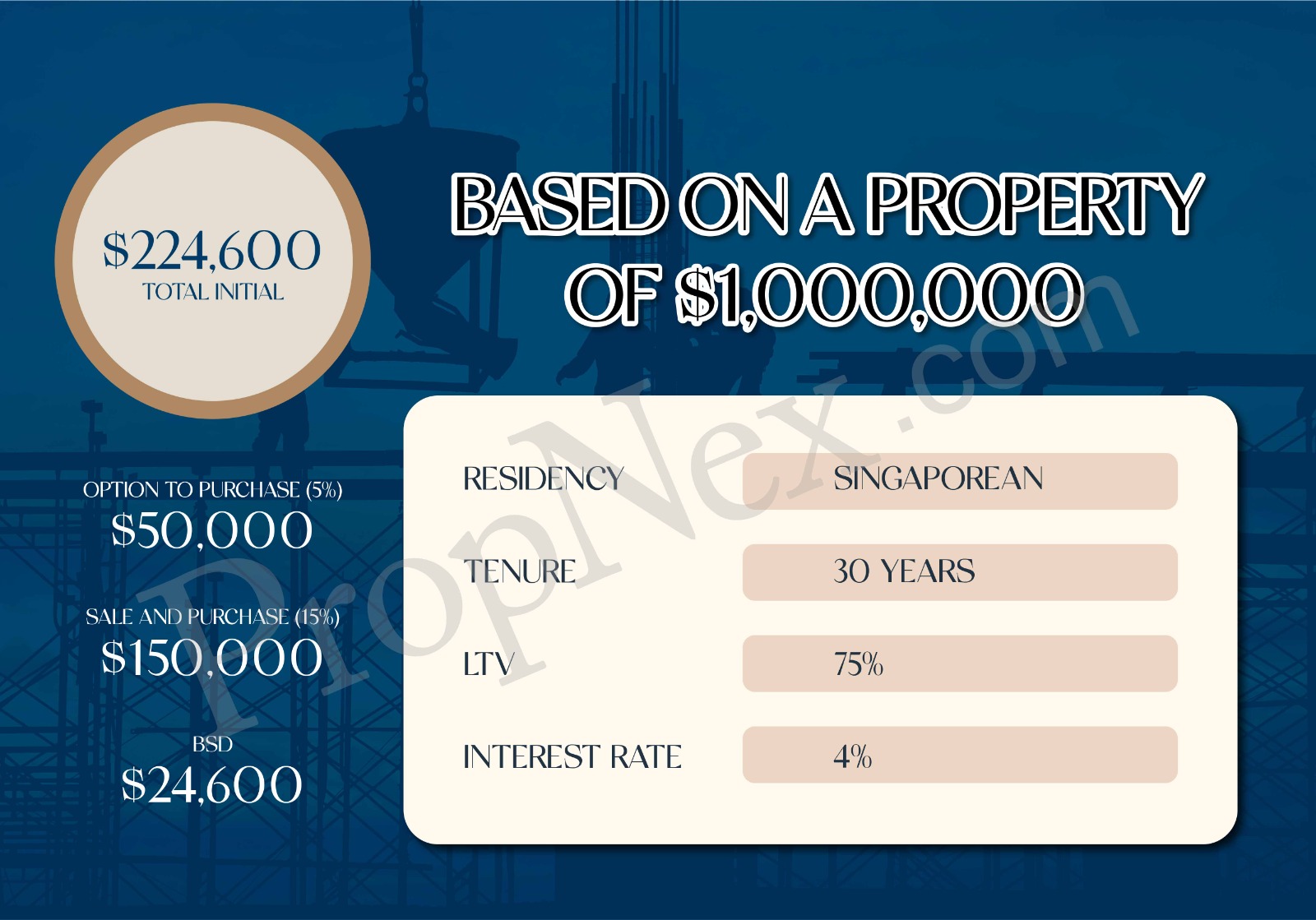

Unlike HDB, where you can take loans of up to 80% of the property's value, loans for private homes can only be secured with the banks. The loan-to-value (LTV) ratio for bank loans is at 75%. It means you have to make a downpayment of 25%, in which 5% has to be cash and the remaining 20% can be a mixture of cash or CPF.

It is very advisable to do an in-principle approval (IPA) with the banks for your home loan. You would have to submit personal documents such as proof of income, credit card statements, CPF history and essential details regarding home loans.

Though getting an IPA for a home purchase is not compulsory, the importance of it cannot be understated. It allows you to have a clear picture of your finances and know the price range of houses you are looking for. Some people jump into placing deposits and booking fees without realising they cannot afford the home they want and end up forfeiting it. Don't have to look silly, especially when getting an IPA from the banks is free-of-charge.

Let's dive right into the crux of it all, choosing between getting a new launch or a resale condominium. There are several differences between the two which you should know before getting one.

New Launch $$ Vs Resale $$

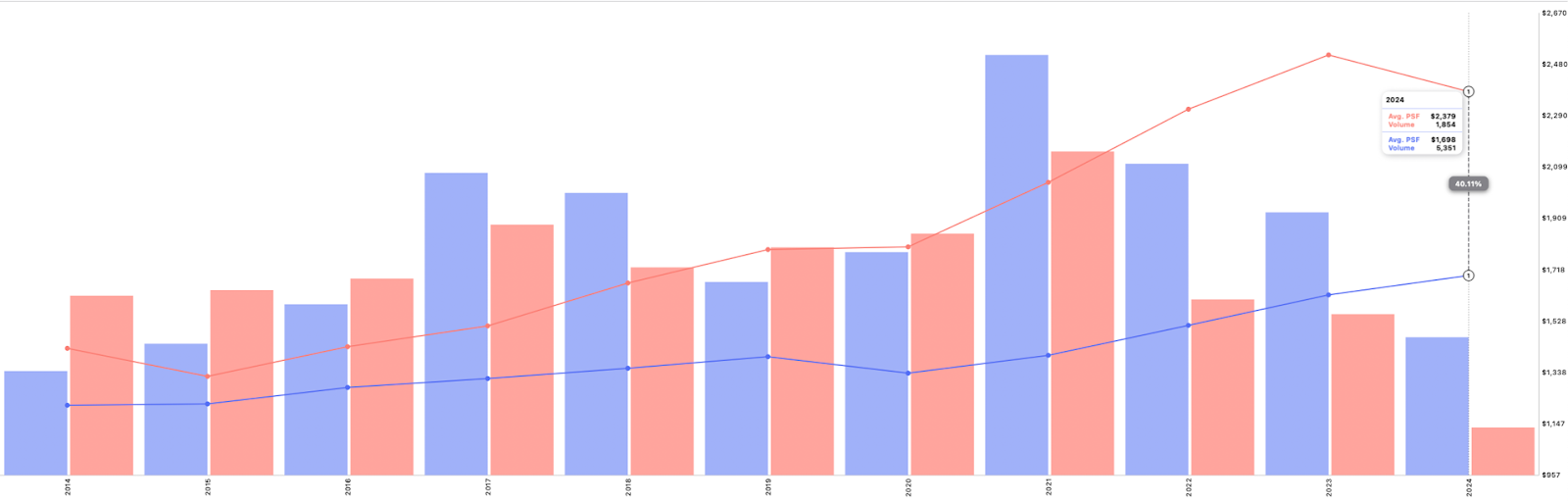

(Source: PropNex Investment Suite)

In 2024, a resale condo averages $1,698 psf, while a new launch condo averages at $2,379 psf. The difference of 40.11% in price point is unsurprising given that you are buying between something brand-new and second-hand.

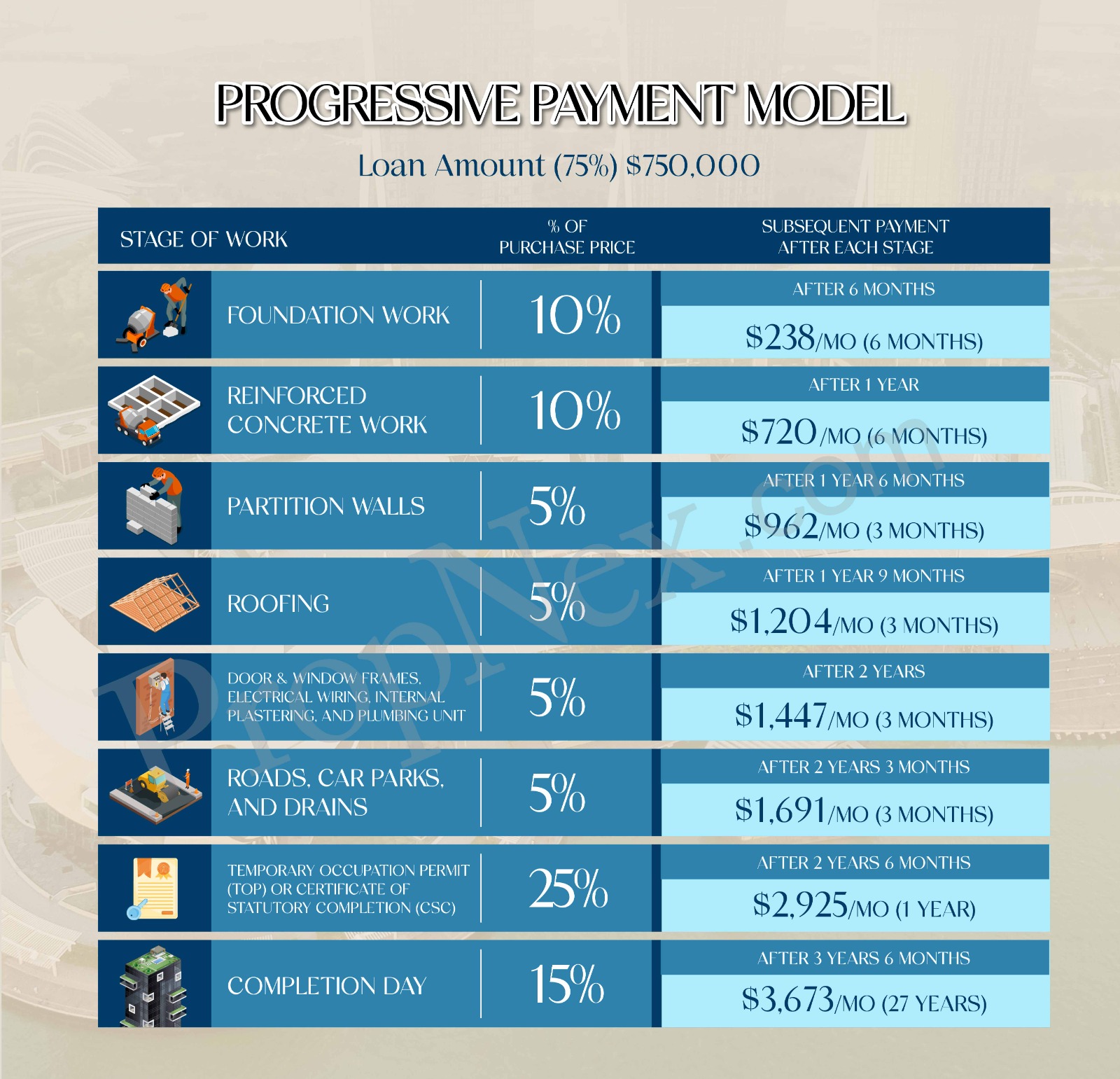

Though the prices of new launches tend to be higher than resales, the biggest perk of buying a new launch is that it adopts a progressive payment model. It won't be as daunting as servicing larger mortgages from the start. Let's take a look at a hypothetical example below, even if the interest rates are as high as 4%, what will the monthly payments be like:

Many people are unaware of the ability to make progressive payments, thinking that they would have to splash out large sums from the start.

Whether you go with a new launch or resale condo, the most important thing that would help you make this decision is understanding the type of lifestyle you yearn for. By making the decision to go for a private property you are already moving in the right direction. Next thing to also consider is probably to go freehold or leasehold. Ultimately, you should still speak to an expert before making any big life's decision, and buying a home is definitely up that alley.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.

Explore Your Options, Contact Us to Find Out More!

Selling your home can be a stressful and challenging process, which is why

it's essential to have a team of professionals on your side to help guide you through the journey. Our

team is dedicated to helping you achieve the best possible outcome when selling your home.

We have years of experience and a proven track record of successfully selling homes in a timely

and efficient manner.